Grade 12 Accounting Project Tasks Case Study for Term 1, 2, 3 and 4 SBA: Memorandum

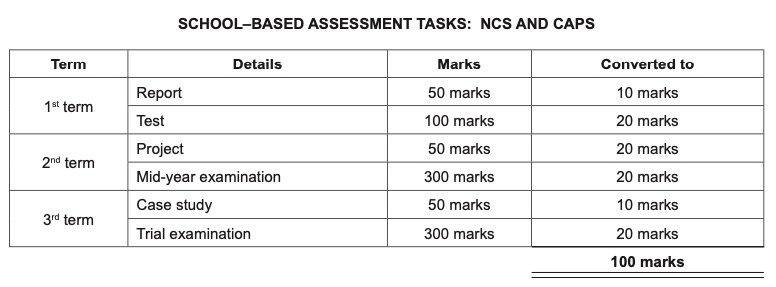

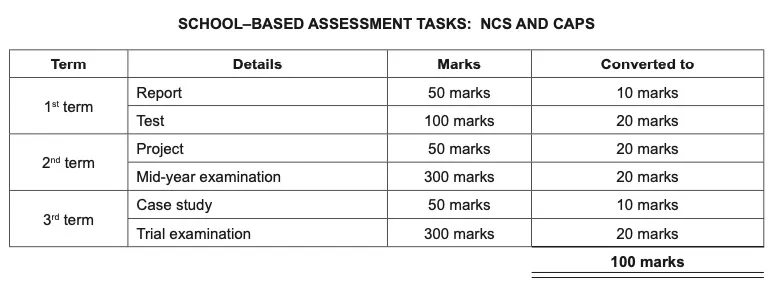

Grade 12 Accounting Project Tasks and Case Studies for Term 1, 2, and 3 (Task A, B, C and D) SBA: Memorandum: The final Grade 12 mark is calculated from the National Senior Certificate (NSC) examination that learners will write (out of 300 marks) plus school-based assessment (out of 100 marks). The curriculum stipulates the following seven formal tasks that comprise school–based assessment in Accounting:

- Accounting Grade 12 Task 1 SBA Written Report 2024 Guide

This is for Accounting Grade 12 subject. The Grade 12 Accounting Project Tasks for Term 1, 2, 3 and 4 SBA: Memorandum study content will help you with your Accounting Subject Revisions, Tests, Exams, and Assignments.

Accounting Grade 12 focuses on measuring performance, and processing and communicating financial information about economic sectors. This discipline ensures that principles such as ethical behaviour, transparency and accountability are adhered to. As a Grade 12 Accounting student, you will be dealing with the logical, systematic and accurate selection and recording of financial information and transactions, as well as the compilation, analysis, interpretation and communication of financial statements and managerial reports for use by interested parties. My Courses

Purposes of Accounting Grade 12 Project Tasks

- The school-based assessment provides a more balanced and trustworthy assessment system, increasing the range and diversity of assessment tasks.

- The exemplar tasks are aimed at reflecting the depth of the curriculum content appropriate for Grade 12.

- They reflect the desired cognitive demands as per Bloom’s revised taxonomy: remembering, understanding, applying, analysing, evaluating, and creating.

- School-based assessment improves the validity of assessment by including aspects that cannot be assessed in formal examination settings.

- It improves the reliability of assessment because judgments will be based on many observations of the learner over an extended period of time.

- There is a beneficial effect on teaching and learning, not only in relation to the critical analysis and evaluation of Accounting information and creative problem-solving but also on teaching and assessment practices.

Accounting Grade 12 School-based Assessments

Accounting Grade 12 Tasks for Term 1

Task a: students are required to report on companies for 20 marks.

- Part A: Report on a public company listed on the JSE .

- Part B: Internal auditor’s report on procedures and internal controls in a public company

Task B: First Term Test: Financial statements of a company

This task includes shares of no par value and repurchase of shares. This task is suitable for Grade 12 learners from 2014 (CAPS).

Task C: Second Term Project:

Published financial statements of Famous Brands Ltd This task is suitable for Grade 12 learners from 2014 (CAPS).

Task D Third Term Case Study: Cash budget and debtors

This task is suitable for Grade 12 learners from 2014 (CAPS)

Best Accounting Courses to study after Matric

Hello learners, do you know that there are plenty of accounting Courses that you can study after matric in South Africa? We have compiled a list of the best accounting courses for you to explore and apply.

Useful Accounting Resources

Accounting Grade 12 Notes

Generally Accepted Accounting Principles: GAAP Grade 12 Grade 12 Accounting Company Ledger accounts Revision Notes Analysis and interpretation of financial statements Grade 12 Accounting Grade 12 Inventory Valuation And Internal Control Questions and Answers Grade 12 Accounting Inventory Systems Notes pdf Grade 12 Accounting: Inventory Valuation and Internal Control Questions and Answers Accounting grade 12 manufacturing Resivion Test with memorandum

Accounting Grade 12 Tests

Grade 12 Accounting Test on Cash Flow and Interpretation Grade 12 Accounting Test on Fixed Assets, Cash Flow Statement and Interpretation Grade 12 Accounting Test on Cash Flow Statement and Interpretation Accounting Grade 12 Balance Sheet and Notes Test (Questions and Answers) Accounting Grade 12 Class Test on Income Statement, Notes, Ratio Analysis and Audit

Looking for something specific?

Did you see these.

- Grade 12 Accounting Questions and Answers for Term 3

- Grade 12 Internal auditor’s report on procedures and internal controls in a public company Guide

- Grade 12 Accounting Term 1 Revision Content

- Grade 12 Accounting Task: Report on a public company listed on the JSE Guide

- Grade 12 Accounting: Inventory Valuation and Internal Control Questions and Answers

- Accounting Grade 12 Free Self-Study Guides + Mind the Gap Study Guide Download

- Grade 12 Accounting Test 1 and Memo

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Accounting Grade 12 Project Tasks Case Study for Term 1, Term 2, Term 3 and Term 4 SBA Memorandum

Accounting Grade 12 Project Tasks Case Study for Term 1, Term 2, Term 3 and Term 4 SBA Memorandum. The final Grade 12 mark is calculated from the National Senior Certificate (NSC) examination that learners will write (out of 300 marks) plus school-based assessment (out of 100 marks). The curriculum stipulates the following seven formal tasks that comprise school–based assessment in Accounting:

Purposes of Accounting Grade 12 Project Tasks

- The school-based assessment provides a more balanced and trustworthy assessment system, increasing the range and diversity of assessment tasks.

- The exemplar tasks are aimed at reflecting the depth of the curriculum content appropriate for Grade 12.

- They reflect the desired cognitive demands as per Bloom’s revised taxonomy: remembering, understanding, applying, analysing, evaluating, and creating.

- School-based assessment improves the validity of assessment by including aspects that cannot be assessed in formal examination settings.

- It improves the reliability of assessment because judgments will be based on many observations of the learner over an extended period of time.

- There is a beneficial effect on teaching and learning, not only in relation to the critical analysis and evaluation of Accounting information and creative problem-solving but also on teaching and assessment practices.

Accounting Grade 12 School-based Assessments

- Examplar: question and answers

Accounting Grade 12 Tasks for Term 1

Task a: students are required to report on companies for 20 marks.

- Part A: Report on a public company listed on the JSE .

- Part B: Internal auditor’s report on procedures and internal controls in a public company

Task B: First Term Test: Financial statements of a company

This task includes shares of no par value and repurchase of shares. This task is suitable for Grade 12 learners from 2014 (CAPS).

Task C: Second Term Project:

Published financial statements of Famous Brands Ltd This task is suitable for Grade 12 learners from 2014 (CAPS).

Task D Third Term Case Study: Cash budget and debtors

This task is suitable for Grade 12 learners from 2014 (CAPS)

- ACCOUNTING-LEARNER-GUIDE-1

- ACCOUNTING-LEARNER-GUIDE-2

Design Grade 12 Practical Assessment Tasks (PAT) for previous years

Design studies caps document lesson plans for fet phase grade 10 – 12, dance studies grade 12 practical assessment tasks (pat) for previous years, dance studies grade 12 free study guide for download, dance studies grade 12 nsc exam topics and structure guide syllabus, electrical technology grade 12 may-june 2022 exam papers and memos pdf.

© www.myexampapers.com. All rights reserved.

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Gr 12 Accounting T3 SOLUTIONS

A guide to the user of the Gr 12 Term 3 SOLUTIONS.

Do you have an educational app, video, ebook, course or eResource?

Contribute to the Western Cape Education Department's ePortal to make a difference.

Home Contact us Terms of Use Privacy Policy Western Cape Government © 2024. All rights reserved.

ACCOUNTING TERM 3 CASE STUDY: BUDGETING

GRADE 12 ACCOUNTING: TERM 3 CASE STUDY BUDGETING: INFORMATION SHEET

JOHN’S DELIVERY SERVICES The information relates to John’s Delivery Services for the budget period July – September 2022. John Dew, the owner, started the business on 1 July 2022, after he was retrenched from his previous employment at a large delivery service company.

John’s investment (capital contribution) in the business comprises:

- His retrenchment package which amounted to R580 000.

- The following fixed assets, at carrying value on 1 July 2022.

To supplement his capital contribution, he has negotiated, and received a loan from Plus Bank for R240 000. The money was deposited into the business bank account on 1 July 2022. The terms of the loan are as follows:

- R6 000 to be paid at the end of each month, commencing on 31 July 2022

- Interest at 14% p.a. payable on the last day of each month (not capitalised).

John also has a fixed deposit that will mature on 31 July 2022. This earns interest at 8,5% p.a. (not capitalised). He intends to use this money and the interest, for business purposes. On 1 July 2022, John purchased a used bakkie for R165 000 in the name of the business, and uses the same depreciation policy for both business vehicles. He employed his cousin, Vinny, to drive this bakkie, making deliveries to clients. Vinny earns a monthly salary of R16 000. John runs the business from premises that he rented from the inception of the business, and pays a fixed monthly rental of R5 500. The premises has a garage for the vehicles, a workshop and an office. He employs his friend as the maintenance and general handyman, who earns R6 000 per month, and a receptionist who manages the clients and the general office administration duties. She is paid R1 120 per week (5 days per week; 4 weeks per month; 7 hours per day). Delivery services are offered to cash and credit customers. Fee income from cash customers accounts for 30% of the budgeted total fee income. Although credit terms are 30 days, John expects 45% of outstanding accounts to be settled in the month of services rendered and 55% to be received in the month following the month of services being rendered. Packing material and other consumable stores are related to the provision of services and is budgeted at 25% of the total fee income.

- 60% of these supplies are purchased on credit.

- Creditors are paid in the month following the month of purchases, to receive the 5% early-payment discount.

The receptionist requested that John reduce her terms of employment as she wants to take up another part-time job opportunity as a tutor for evening class learners, commencing on 1 September 2022. John agreed to this proposal as the receptionist is mainly needed in the mornings. As from 1 September, she will work for only 4 hours per day (instead of the 7 hours) and her pay will be adjusted accordingly. Extract from the Cash Budget for the Budget period:

Incomplete Debtors Collection Schedule:

Comparison of PROJECTED figures and ACTUAL figures for July 2022:

Related items

- ACCOUNTING PAPER 2 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

- ACCOUNTING PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

- ACCOUNTING PAPER 1 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

- ACCOUNTING PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS NOVEMBER 2021

- GEOGRAPHY TEST 2 - 2022

IMAGES

COMMENTS

Aug 17, 2021 · Province of the EASTERN CAPE DEPARTMENT OF EDUCATION CURRICULUM SUPPORT AND MANAGEMENT Note to Learners: The case study comprises TWO separate Questions. Answer both Questions in the special Answer Book provided. Show all workings to earn part marks. Question 1: (28 marks) The information rela...

Jan 2, 2024 · Grade 12 Accounting Project Tasks and Case Studies for Term 1, 2, and 3 (Task A, B, C and D) SBA: Memorandum: The final Grade 12 mark is calculated from the National Senior Certificate (NSC) examination that learners will write (out of 300 marks) plus school-based assessment (out of 100 marks). The curriculum stipulates the

Nov 3, 2022 · 2021 Grade 12 Accounting Assignment 3 - Case Study TASK TASK NAME TASK DETAIL MARK Task 6 Assignment 3 - Case Study A case study is where you are given a scenario and some problem solving questions and using the information given you are required to answer some questions. The topic is Budgeting 50 Assessment

ACCOUNTING GRADE 12 – 2021 AUGUST CASE STUDY: MARKING GUIDELINES MARKS Total Learner QUESTION 1: MANUFACTURING 1.1 Direct Material Cost Allocate marks as per marking guidelines 7 Factory overheads cost 10 Production Cost Statement 7 1.2 Decisions by management 4 1.3 Problem solving 4 1.4 Break-even calculations and analysis 10

Sep 3, 2021 · Accounting paper 1 grade 12 September 2021 memorandum, grade 12 Accounting paper 2 Term 3 2021, Accounting paper 2 grade 12 Term 3 2021 memo, Accounting p2 September 2021, Accounting paper 2 grade 12 2021. Find a list of Accounting Grade 12 September 2021 preparatory trial exam papers with the memorandums below:

Accounting Grade 12 Project Tasks Case Study for Term 1, Term 2, Term 3 and Term 4 SBA Memorandum. The final Grade 12 mark is calculated from the National Senior Certificate (NSC) examination that learners will write (out of 300 marks) plus school-based assessment (out of 100 marks).

ACCOUNTING GRADE 12 – 2021 AUGUST CASE STUDY: ANSWER SHEET NAME: MARKS: 50 DATE: DURATION: 90 MINUTES MARKS Total Learner QUESTION 1: MANUFACTURING 1.1 Direct Material Cost Allocate marks as per marking guidelines 7 Factory overheads cost 10 Production Cost Statement 7 1.2 Decisions by management 4 1.3 Problem solving 4 1.4

Aug 21, 2020 · A guide to the user of the Gr 12 Term 3 SOLUTIONS. ... Grade 11 Grade 12 ... 2021 Gr.12 Examination Guidelines ...

GR 12 ACCOUNTING: TERM 3 CASE STUDY COST ACCOUNTING MARKING GUIDELINE 1.1 Raw material: 1.1.1 Calculate the closing stock of raw materials (fabric) using the first-in-first-out stock valuation method. 210m x 55 = 11 550 120m x 52 = 6 240 = 17 790 6 1.1.2 Calculate the total Direct Material Cost

Aug 19, 2022 · GRADE 12 ACCOUNTING: TERM 3 CASE STUDY BUDGETING: INFORMATION SHEET JOHN’S DELIVERY SERVICESThe information relates to John’s Delivery Services for the budget period July – September 2022.John Dew, the owner, started the business on 1 July 2022, after he was retrenched from his previous employment a...